Advertisement

-

Published Date

October 3, 2018This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

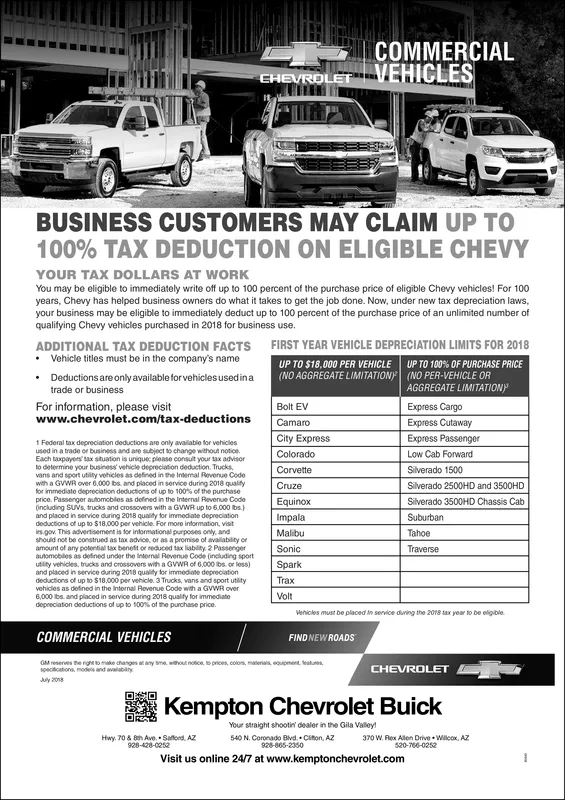

COMMERCIAL r | VEHICLES BUSINESS CUSTOMERS MAY CLAIM UP TO 100% TAX DEDUCTION ON ELIGIBLE CHEVY YOUR TAX DOLLARS AT WORK You may be eligible to immediately write off up to 100 percent of the purchase price of eligible Chevy vehicles! For 100 years, Chevy has helped business owners do what it takes to get the job done. Now, under new tax depreciation laws, your business may be eligible to immediately deduct up to 100 percent of the purchase price of an unlimited number of qualifying Chevy vehicles purchased in 2018 for business use. ADDITIONAL TAX DEDUCTION FACTS FIRST YEAR VEHICLE DEPRECIATION LIMITS FOR 2018 Vehicle titles must be in the company's name UP TO $18,000 PER VEHICLE (NO AGGREGATE LIMITATION UP TO 100% OF PURCHASE PRICE Deductions are only available forvehicles usedina (NO PER-VEHICLE OR AGGREGATE LIMITATIOWY Express Cargo Express Cutaway Express Passenger Low Cab Forward Silverado 1500 Silverado 2500HD and 3500HD Silverado 3500HD Chassis Cab Suburban Tahoe Traverse trade or business For information, please visit www.chevrolet.com/tax-deductions Bolt EV Camaro 1 Federal tax depreciation deductions are only available for vehicles used in a trade cr busines and aesuject to change without notice. Eacl, taxpayers' tax stuatorn is unque. please consult your tax advisor to determine your business vehicle depreciation deduction. Trucks ans and sport utiity vohicles as defined in he Imemal Rovenue Code wth a GvWR over 6,000 bs and paced in service during 2018 qualiy for immediate deprecation deductions of up to 100% of the purchase price. Passenger automobiles as defined in the internal Revenue Code ncluding SUNs, trucks and crossovers with a GVWR up to 6,000 bs.) and placed in service during 20s8 quality for immediate depreciation doductions of up to $18,000 per vehicle. For more information, visit s-gov. This advertisement is for informational purposes ony and shouid net be construed as tax advice, or as a promise of avalability or amount of any potnti tax benet or neduced tax liability 2 Passenger automobles as detined under the Internal Revenue Code (including sport utity vehicles, tracks and crossovers with a GVWR of 6,000 bs or less and placed in service during 208 quality for immediate depreciation deductions of up to $18,000 per vehicle. 3 Trucks, vans and sport utity vehidles as defined in the Internal Revenue Code with a GVWR over 6,000 bs and placed in service during 2018 quality for immediato deprecaion deductions of up to 100% of to puchase proe. Corvette Cruze Equinox Impala Mal bu Sonic Spark Volt ehicles must be placed in sevvice duning the 2018 tax year to be eligible COMMERCIAL VEHICLES FINDNEW ROADS and avalabay CHEVROLET A July Kempton Chevrolet Buick Your straight shootin' dealer in the Gila Valley! 540 N. Coronado Bvd Citon, AZ 370 W. Rlex Allen Drve Willccx, AZ 520-60-0252 928-428-0252 Visit us online 24/7 at www.kemptonchevrolet.com